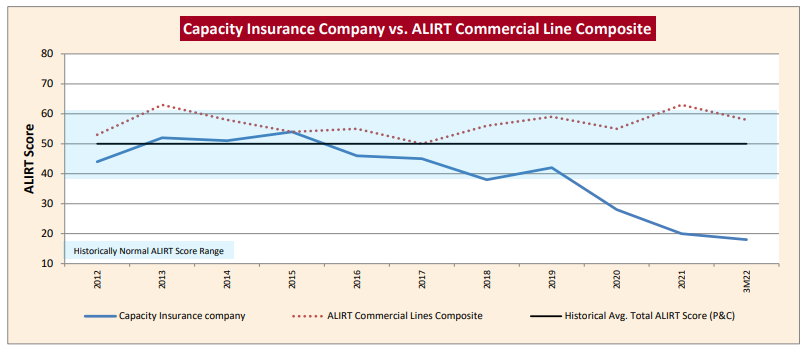

The Insurtech “Full Stack” Strategy Starts to Sputter

Insurtech firms have made a big splash in the U.S. Property & Casualty market over the past 6-7 years, most initially as tech-enabled distributors of insurance but increasingly as underwriters as well.

Homeowners Insurance Market Residual Market Trends in Higher Risk States

Register to read full abstract Already registered? Login here

U.S. Life Insurers’ Bermuda Reinsurance Exposure

The U.S. Life Insurance Industry has long utilized foreign reinsurance as part of its risk and capital

management strategies. In recent years the use of Bermuda reinsurance in particular has become

increasingly common among life insurers (especially for individual annuities), raising some concerns

among industry participants.

Louisiana Homeowners Insurance Market Update

Register to read full abstract Already registered? Login here

ALIRT Research – Florida Domestic Insurer Market Update

If any market observers still harbored doubts about the dire condition of the Florida homeowners’ market, events over the last several weeks have likely laid them to rest.

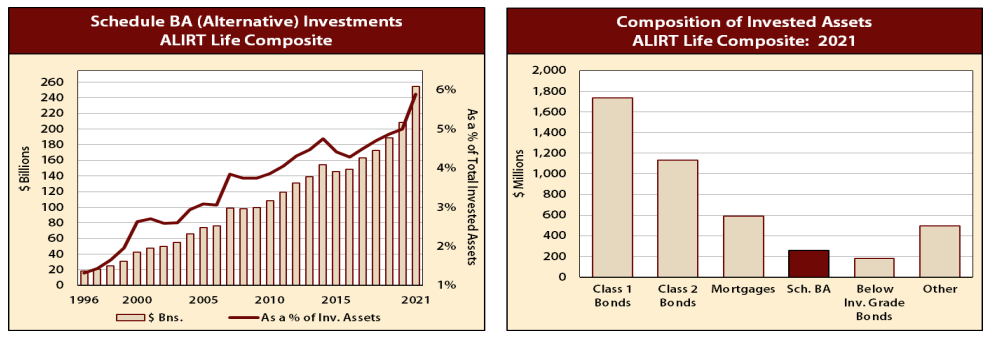

U.S. Life Insurer Exposure to Alternative (Schedule BA) Investments

Life insurance companies’ investment portfolios are heavily oriented to fixed income assets such as bonds (both “traditional” bonds and structured securities) and mortgage loans. These assets, together with policy loans and cash, comprised around 90% of total life insurance industry investments in each of the last five years.

Fronting Insurers On the Move

Register to read full abstract Already registered? Login here

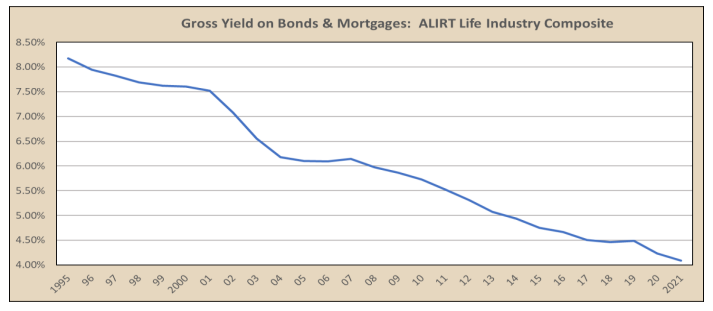

Higher Interest Rates and Life Insurance and Annuity Companies

The direction and level of interest rates have considerable impact on life insurance companies and their reported financial results. This is the result of several factors, which include but are not limited to the following

Below Investment Grade Bond Exposure for Life Insurers

Below Investment Grade (BIG) bonds consist of all bonds rated BB+/Ba1 or lower by public rating agencies.

In the statutory financial statement, there are four different “Classes” of BIG bonds (and their S&P ratings):

Florida Domestic Insurer Market Update

It is fitting to be updating this Florida Domestic Insurer market review in 2022, a year which marks the 30th anniversary of Hurricane Andrew. This storm, which made landfall as a category 5 hurricane, wreaked extensive property damage in Homestead and surrounding environs, but more importantly upended the personal and commercial property insurance market in the entire Sunshine State. (Re)insurers realized all at once that their rates were wholly inadequate for the exposure to potential catastrophic wind losses. Carriers began exiting the market en masse, resulting in a coverage crisis.